Disclaimer:

As independent contractors, Faber Work Users have the responsibility to keep track of all earnings and ensure that all earnings are accurately reported when filing annual income tax returns. Any questions about reporting on your income tax returns should be directed to a local tax professional.

Please note that Faber Technologies, Inc. developed the content contained in this article to assist with the preparation of income tax returns. This article should not be taken as professional advice about your taxes. If you have further questions, we advise you to seek the advice of a tax professional to assist with your income tax preparation.

For Faber Work Users in the US

How to retrieve a copy of your 1099 form

For Faber Work Users in Canada

In Canada, the Canada Revenue Agency (CRA) administers all income taxes. The CRA requires that a corporation involved in construction activities which provide its primary source of business income and makes payments to subcontractors for construction services must report amounts paid or credited.

As a subcontractor of Faber, all payments you have received are reported to the CRA. Faber reports all amounts paid to you each calendar year on Form T5018. This form is provided to CRA for matching purposes.

In order to assist you with your income tax filings, we will make a copy of the information filed on this T5018 form (for the 2020 calendar year) available to you by February 28, 2021, on the Faber Work app.

How to retrieve a copy of your T5018 form

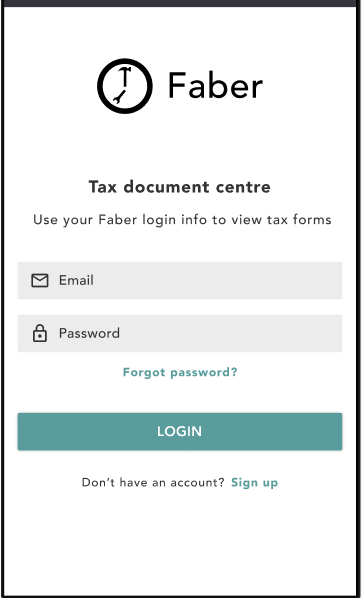

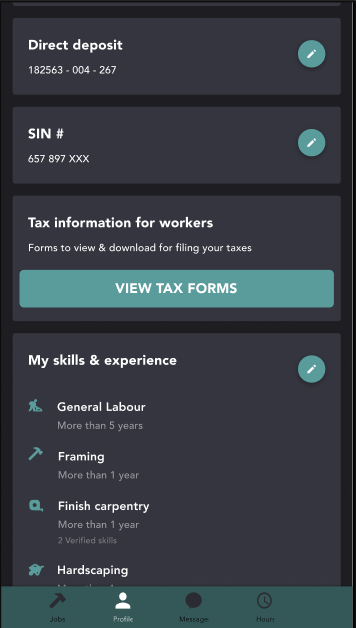

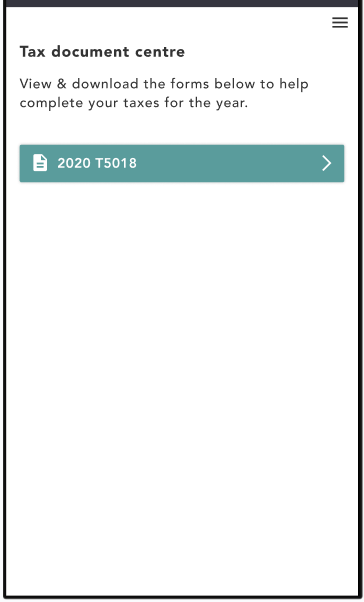

Your copy of the T5018 information can be retrieved at any time by visiting the “View Tax Forms” section of the Faber Work app. After clicking on the “View Tax Forms” button, you can click the “2020 T5018” option to access a copy of your tax information.

This will take you to the Tax Document Centre built into the Faber platform. You will have a copy of your 2020 T5018 information ready to view and download on February 28, 2021. The information can be taken to your accountant to help with filing your taxes.

Please note that Faber is simply reporting the amounts paid to you during the year. As an independent contractor, Faber has not withheld any taxes for remittance and the responsibility to pay your income taxes rests solely with you. Please direct any tax inquiries to your local tax professional.